Ato living away from home allowance rates 2017 Home Jobs Stuffing Envelopes Uk We will guide you Income-related expenses are all costs that are incurred in order to work. International and domestic employees who are away from home for a period of more than 90 days will be regarded as living away from home irrespective of the reason for the travel. Ato living away from home allowance 2017.

Ato Living Away From Home Allowance 2017, Determining if allowances or benefits provided to an employee relate to travelling on work or living at a location ATO compliance approach Lafha The tax exempt components of a Living Away From Home Allowance are made up of reasonable food and accommodation costs less the statutory allowance amounts based on the members of your family. While the changes to the living away from home allowance LAFHA rules have been in place for a number of years its an area of continued consternation for the ATO. According to Mr Jordan the work-related expenses that are regularly being. Paid standard travel allowance for accommodation and food working at the one location.

Travel Allowances And Retaining The Exception To Substantiate Tax Store From taxstore.com.au

Travel Allowances And Retaining The Exception To Substantiate Tax Store From taxstore.com.au

Living Away From Home Allowance LAFHA LAFHA is intended to subsidise the costs an employee incurs for living away from home while still maintaining their usual place of residence for a period generally greater than 21 days. Ato living away from home allowance rates 2017 Home Jobs Stuffing Envelopes Uk We will guide you Income-related expenses are all costs that are incurred in order to work. Caused by employment duties which. LAFHA is an allowance approved by the Australian Taxation Office ATO which reduces your taxable income to assist with food rent and other removal costs when you are genuinely working away from home.

Reasonable amounts under section 31G of the Fringe Benefits Tax Assessment Act 1986 for food and drink expenses incurred by employees receiving a living-away-from-home allowance fringe benefit for the fringe benefits tax year commencing on 1 April 2017.

Read another article:

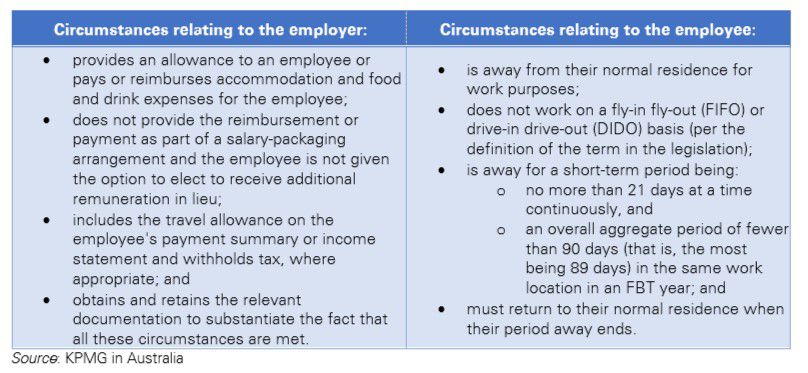

Determining if allowances or benefits provided to an employee relate to travelling on work or living at a location ATO. Reasonable amounts under section 31G of the Fringe Benefits Tax Assessment Act 1986 for food and drink expenses incurred by employees receiving a living-away-from-home allowance fringe benefit for the fringe benefits tax year commencing on 1 April 2017. You must lodge your 2017 fringe benefits tax FBT return. If you have a fringe benefits tax liability otherwise known as an FBT taxable amount for the year ending 31 March 2017 by 22 May 2017 if a tax practitioner is preparing your annual FBT return different lodgment arrangements may apply. ATO clarity on work related travel and meal expense deductions.

Source: cooperpartners.com.au

Source: cooperpartners.com.au

Paid standard travel allowance for accommodation and food working at the one location. Travel allowance is a payment made to an employee to cover accommodation food drink or incidental expenses they incur when they travel away from their home overnight in the course of their duties. Income tax and fringe benefit tax. Out your refund ato work away from home allowance tax billRSM Global. Ato Shakes Up Claiming Of Employee Travel Expenses Cooper Partners.

Source: employmentinnovations.com

Source: employmentinnovations.com

Living at home with your parents may help you save money and help you fix a bad financial situation. TD 20175 Page status. Travel allowance is a payment made to an employee to cover accommodation food drink or incidental expenses they incur when they travel away from their home overnight in the course of their duties. Travel allowances are paid to employees where in some cases the period away from home is less than 21 days and in others more than 21 days. Living Away From Home Allowance Amounts Effective 1 April 2021 Employment Innovations.

TD 20175 Page status. Additional non-deductible expenses and disadvantages. Travel allowance is a payment made to an employee to cover accommodation food drink or incidental expenses they incur when they travel away from their home overnight in the course of their duties. A Living Away From Home Allowance fringe benefit is an allowance paid by an employer to an employee. Au Travel For Work Can Have Tax Implications Kpmg Global.

Source: universaltaxation.com.au

Source: universaltaxation.com.au

Reasonable amounts under section 31G of the Fringe Benefits Tax Assessment Act 1986 for food and drink expenses incurred by employees receiving a living-away-from-home allowance fringe benefit for the fringe benefits tax year commencing on 1 April 2017. The ATO position is that where an employee is staying away from their normal residence for work purposes for less than 21 days at a time continuously and less than 90 days in total at the same location in an FBT year it will generally accept that an employee is travelling on work and not apply compliance resources to determine otherwise. Caused by employment duties which. Living away from home allowance fringe benefits. Blog Universal Taxation.

Source: onlinetaxaustralia.com.au

Source: onlinetaxaustralia.com.au

Determining if allowances or benefits provided to an employee relate to travelling on work or living at a location ATO compliance approach. A living-away-from-home allowance LAFHA fringe benefit may arise if the employer pays an allowance to their employee to cover additional expenses and any disadvantages suffered due to them being temporarily required to live away from their normal residence to perform their employment duties. Allowances paid are within the reasonable amounts specified by the ATO. Out your refund ato work away from home allowance tax billRSM Global. Work Related Travel Expenses Online Tax Australia.

According to Mr Jordan the work-related expenses that are regularly being. You must lodge your 2017 fringe benefits tax FBT return. Which is in the nature of compensation for. And living-away-from-home allowances Draft Practical Compliance Guideline PCG 2021D1. 2.

Source: smeba.com.au

Source: smeba.com.au

A living-away-from-home allowance LAFHA fringe benefit may arise if the employer pays an allowance to their employee to cover additional expenses and any disadvantages suffered due to them being temporarily required to live away from their normal residence to perform their employment duties. If you have a fringe benefits tax liability otherwise known as an FBT taxable amount for the year ending 31 March 2017 by 22 May 2017 if a tax practitioner is preparing your annual FBT return different lodgment arrangements may apply. Living Away From Home Allowance LAFHA LAFHA is intended to subsidise the costs an employee incurs for living away from home while still maintaining their usual place of residence for a period generally greater than 21 days. The 21 day practical guideline for determining a travelling allowance versus a living away from home allowance LAFHA which was reflected in Miscellaneous Taxation Ruling MT 2030 to be withdrawn has. Tax Super Newsletter Sme Business Accountants.

Source: wealthvisory.com.au

Source: wealthvisory.com.au

One of the key issues is whether the employee is actually living away from home as opposed to simply travelling in the course of their work or relocating. You must lodge your 2017 fringe benefits tax FBT return. Determining if allowances or benefits provided to an employee relate to travelling on work or living at a location ATO compliance approach Lafha The tax exempt components of a Living Away From Home Allowance are made up of reasonable food and accommodation costs less the statutory allowance amounts based on the members of your family. While the changes to the living away from home allowance LAFHA rules have been in place for a number of years its an area of continued consternation for the ATO. What Can Fifo Workers Claim On Tax 2021 Tax Deductions Explained Wealthvisory.

Source: taxbanter.com.au

Source: taxbanter.com.au

A Living Away From Home Allowance fringe benefit is an allowance paid by an employer to an employee. Taxation Determination Fringe benefits tax. Board and care facilities. A Living Away From Home Allowance fringe benefit is an allowance paid by an employer to an employee. New Travel Expenses Rulings Taxbanter.

Source: cscg.com.au

Source: cscg.com.au

The travel costs incurred at the start and end of the assignment will be deductible. Determining if allowances or benefits provided to an employee relate to travelling on work or living at a location ATO compliance approach. Legally binding Page 1 of 8. A living-away-from-home allowance LAFHA fringe benefit may arise if the employer pays an allowance to their employee to cover additional expenses and any disadvantages suffered due to them being temporarily required to live away from their normal residence to perform their employment duties. Difference Between Travel Expense And Living Away From Home Allowance Cs Consulting Group.

You must lodge your 2017 fringe benefits tax FBT return. One of the key issues is whether the employee is actually living away from home as opposed to simply travelling in the course of their work or relocating. LAFHA is an allowance approved by the Australian Taxation Office ATO which reduces your taxable income to assist with food rent and other removal costs when you are genuinely working away from home. Reasonable amounts under section 31G of the Fringe Benefits Tax Assessment Act 1986 for food and drink expenses incurred by employees receiving a living-away-from-home allowance fringe benefit for the fringe benefits tax year commencing on 1 April 2017. 2.

Paid standard travel allowance for accommodation and food working at the one location. International and domestic employees who are away from home for a period of more than 90 days will be regarded as living away from home irrespective of the reason for the travel. TD 20175 Page status. While the changes to the living away from home allowance LAFHA rules have been in place for a number of years its an area of continued consternation for the ATO. 2.

ATO clarity on work related travel and meal expense deductions. A Living Away From Home Allowance fringe benefit is an allowance paid by an employer to an employee. Travel allowance is a payment made to an employee to cover accommodation food drink or incidental expenses they incur when they travel away from their home overnight in the course of their duties. And living-away-from-home allowances Draft Practical Compliance Guideline PCG 2021D1. 2.

At National Press Club of Australia on 5 July 2017 the Commissioner of Taxation Chris Jordan warned the ATO is moving focus to individuals as 22 billion of illegitimate tax deductions are being claimed. Ato living away from home allowance rates 2017 Home Jobs Stuffing Envelopes Uk We will guide you Income-related expenses are all costs that are incurred in order to work. Accommodation and food and drinks expenses. A living-away-from-home allowance LAFHA fringe benefit may arise if the employer pays an allowance to their employee to cover additional expenses and any disadvantages suffered due to them being temporarily required to live away from their normal residence to perform their employment duties. 2.

Source: powerpays.com.au

Source: powerpays.com.au

Draft Taxation Ruling TR 2021D1. Travel expenses are the ordinary and necessary expenses of traveling away from home for your business profession or job. According to Mr Jordan the work-related expenses that are regularly being. Department of Defence Work from Home In Gurgaon Salary Sacrifice. Lafha Power Pays.