Averages include all 30-year loans. Imagine you applied for a personal loan of RM100000 at a flat interest rate of 5 pa. Asb home loan rate report.

Asb Home Loan Rate Report, 2 Rate and fee data were sourced from self-reported loan data that all mortgage lenders are required to file each year under the Home Mortgage Disclosure Act. Term Loan - This home loan allows you to have a maximum loan tenure of 35 years. Provide evidence of the loss - photographs of the damage to your home a police report etc. Imagine you applied for a personal loan of RM100000 at a flat interest rate of 5 pa.

Asb News Highlights From annabank.com

Asb News Highlights From annabank.com

AA-Savings Plus - base rate. The flat interest rate is mostly used for personal and car loans. Do a quick check on your monthly repayment with Loanstreet s home loan calculator and apply online right away. Averages include all 30-year loans.

When you are approved for a loan you will need to agree to a loan contract that sets out certain terms.

Read another article:

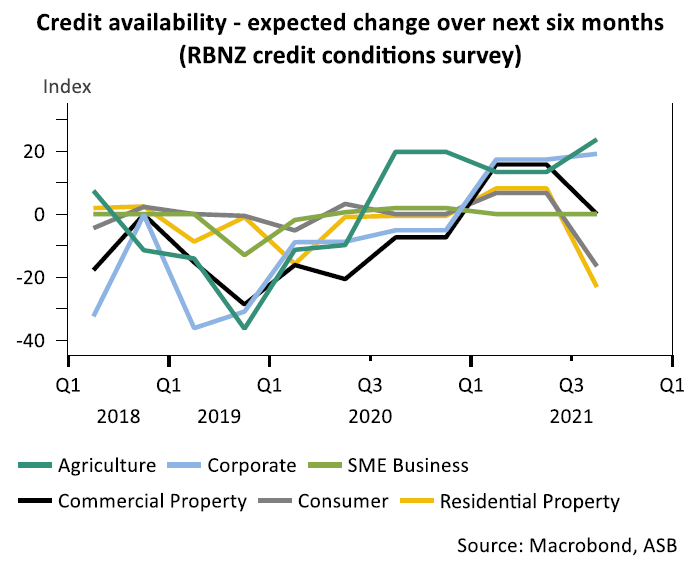

Residential auction results Residential rent report Commercial property sales Farms sold Sprawl visualisations Home loan affordability Median multiples Commercial building consent analysis Residential building consent analysis Rental yield indicator Rent ratio. This means being able to use leverage to generate larger profits than just relying on your savings alone. With an ASB loan you can borrow up to RM200000 to invest in ASB immediately. As they were deemed to be in breach of their loan conditions the bank was able to charge increased interest rates or require early repayment. ASB KiwiSaver Scheme Investor Hub.

Source: asb.co.nz

Source: asb.co.nz

A flat interest rate is always a fixed percentage. A 15year fixedrate mortgage would cost only about. Fixed-rate mortgage loans allow you to know how much money youll spend on interest over the life of your loan as well as. Current mortgage rates are averaging 310 for a 30-year fixed-rate loan 238 for a 15-year fixed-rate loan and 245 for a 51 adjustable-rate mortgage according to Freddie Macs latest. Home Loan Rate Report Economic Research Asb.

Source: canstar.co.nz

Source: canstar.co.nz

Commonwealth Bank declared 1958 out of 26000 BankWest commercial loans impaired in default of the loan terms with a total face value of 179 billion. With an ASB loan you can borrow up to RM200000 to invest in ASB immediately. These terms include how long you will have to repay the loan the loan term what fees you need to pay and the rate of interest you will be charged on your loan amount. Current mortgage rates are averaging 310 for a 30-year fixed-rate loan 238 for a 15-year fixed-rate loan and 245 for a 51 adjustable-rate mortgage according to Freddie Macs latest. Canstar S Best Bank For First Home Buyers Asb Canstar.

Source: canstar.co.nz

Source: canstar.co.nz

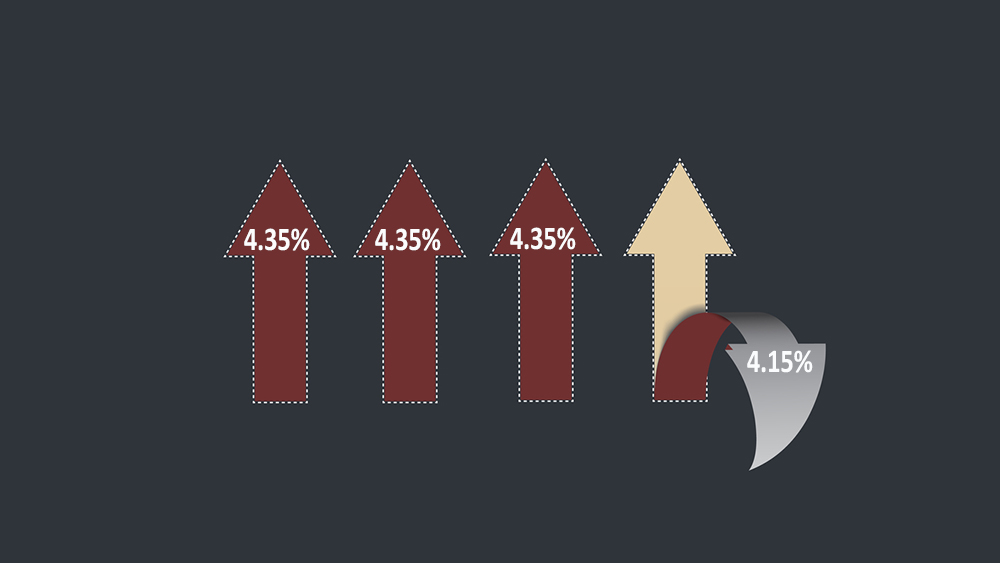

Keeping you up to date with the latest insights market commentary and updates from our team of experts. This means being able to use leverage to generate larger profits than just relying on your savings alone. Get interest rate from as low as 415 on home refinancing with Zero Entry Cost. Freelance economist Tony Alexander says since the Covid pandemic struck. Lowest Construction Loan Interest Rate Deals Canstar.

Source: scoop.co.nz

Source: scoop.co.nz

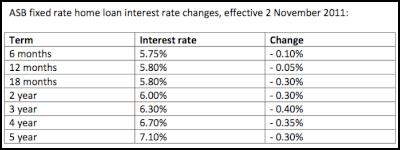

If you pay off your home loan earlier within the first 3 to 5 years you will be charged a penalty fee of approximately 3. In this case you will be paying 5 interest every year on the RM100000 loan that youve taken. With an ASB loan you can borrow up to RM200000 to invest in ASB immediately. In the case of flooding it can take weeks or longer for a property to dry out. Asb Cuts Fixed Home Loan Interest Rates Scoop News.

Source: goodreturns.co.nz

Source: goodreturns.co.nz

The central bank lifted the official cash rate OCR by 25 basis points on Wednesday which prompted ASB and ANZ to increase some of its savings account and home loan rates by a similar margin. With a tenure of 10 years. In place of interest a profit rate is defined in the contract. Compare the cheapest housing loans from over 15 banks in Malaysia here. Asb Pulls Pricing Lever On Home Loans Good Returns.

Source: interest.co.nz

Source: interest.co.nz

Keeping you up to date with the latest insights market commentary and updates from our team of experts. In the case of flooding it can take weeks or longer for a property to dry out. If you are confident that you will be able to consistently service your. Current mortgage rates are averaging 310 for a 30-year fixed-rate loan 238 for a 15-year fixed-rate loan and 245 for a 51 adjustable-rate mortgage according to Freddie Macs latest. Asb Does It Again Leading Mortgage Rates Higher Interest Co Nz.

Source: homeworklib.com

Source: homeworklib.com

Current mortgage rates are averaging 310 for a 30-year fixed-rate loan 238 for a 15-year fixed-rate loan and 245 for a 51 adjustable-rate mortgage according to Freddie Macs latest. Get interest rate from as low as 415 on home refinancing with Zero Entry Cost. Current mortgage rates are averaging 310 for a 30-year fixed-rate loan 238 for a 15-year fixed-rate loan and 245 for a 51 adjustable-rate mortgage according to Freddie Macs latest. The central bank lifted the official cash rate OCR by 25 basis points on Wednesday which prompted ASB and ANZ to increase some of its savings account and home loan rates by a similar margin. Adirondack Savings Bank Asb Has 1 Million In New Funds That Must Be Allocated To Home Loans P Homeworklib.

2 Rate and fee data were sourced from self-reported loan data that all mortgage lenders are required to file each year under the Home Mortgage Disclosure Act. ASBs latest forecasts are for house prices to drop over the second half of. ASB the first bank to increase floating home loan rates following the 25 basis points OCR rise but only by 15 basis points ANZ adds 20 basis points Kiwibank Westpac and BNZ add 25 bps Wednesdays OCR rise of 25 basis points brought an immediate move by. Compare the cheapest housing loans from over 15 banks in Malaysia here. Asb Bank Own That Home With Our Special Home Loan Facebook.

Source: canstar.co.nz

Source: canstar.co.nz

If you are confident that you will be able to consistently service your. ASB the first bank to increase floating home loan rates following the 25 basis points OCR rise but only by 15 basis points ANZ adds 20 basis points Kiwibank Westpac and BNZ add 25 bps Wednesdays OCR rise of 25 basis points brought an immediate move by. Compare the cheapest housing loans from over 15 banks in Malaysia here. Current mortgage rates are averaging 310 for a 30-year fixed-rate loan 238 for a 15-year fixed-rate loan and 245 for a 51 adjustable-rate mortgage according to Freddie Macs latest. Lowest Construction Loan Interest Rate Deals Canstar.

Source: pinterest.com

Source: pinterest.com

At a 3 interest rate for a 200000 home loan youd pay 103000 in interest charges with a 30year mortgage paid off on schedule. 2 Rate and fee data were sourced from self-reported loan data that all mortgage lenders are required to file each year under the Home Mortgage Disclosure Act. ASB the first bank to increase floating home loan rates following the 25 basis points OCR rise but only by 15 basis points ANZ adds 20 basis points Kiwibank Westpac and BNZ add 25 bps Wednesdays OCR rise of 25 basis points brought an immediate move by. Get interest rate from as low as 415 on home refinancing with Zero Entry Cost. Welcome To Nginx Web Banking Business Person Bank Branding.

Source: interest.co.nz

Source: interest.co.nz

Current mortgage rates are averaging 310 for a 30-year fixed-rate loan 238 for a 15-year fixed-rate loan and 245 for a 51 adjustable-rate mortgage according to Freddie Macs latest. ASB the first bank to increase floating home loan rates following the 25 basis points OCR rise but only by 15 basis points ANZ adds 20 basis points Kiwibank Westpac and BNZ add 25 bps Wednesdays OCR rise of 25 basis points brought an immediate move by. This means being able to use leverage to generate larger profits than just relying on your savings alone. Most Hawaii residents choose this option when financing a home. Asb Leads A Key Home Loan Rate Lower Interest Co Nz.

If you pay off your home loan earlier within the first 3 to 5 years you will be charged a penalty fee of approximately 3. The majority of Islamic home financing options in Malaysia today are based on the Bai Bithamin Ajil BBA concept. In place of interest a profit rate is defined in the contract. Current mortgage rates are averaging 310 for a 30-year fixed-rate loan 238 for a 15-year fixed-rate loan and 245 for a 51 adjustable-rate mortgage according to Freddie Macs latest. Asb Promises No Forced Sales Of Family Homes As Its Interim Profit Rises Interest Co Nz.

Source: elibrary.imf.org

Source: elibrary.imf.org

ASBs latest forecasts are for house prices to drop over the second half of. This means being able to use leverage to generate larger profits than just relying on your savings alone. The majority of Islamic home financing options in Malaysia today are based on the Bai Bithamin Ajil BBA concept. Like Conventional Financing profit rates can be a fixed rate or based on a floating rate eg. Belgium 2021 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For Belgium In Imf Staff Country Reports Volume 2021 Issue 209 2021.

Source: researchgate.net

Source: researchgate.net

Like Conventional Financing profit rates can be a fixed rate or based on a floating rate eg. In this case you will be paying 5 interest every year on the RM100000 loan that youve taken. Like Conventional Financing profit rates can be a fixed rate or based on a floating rate eg. At a 3 interest rate for a 200000 home loan youd pay 103000 in interest charges with a 30year mortgage paid off on schedule. Pdf A Multi State Approach To Modelling Intermediate Events And Multiple Mortgage Loan Outcomes.

Source: nowyoureadme.com

Source: nowyoureadme.com

Get interest rate from as low as 415 on home refinancing with Zero Entry Cost. In the case of flooding it can take weeks or longer for a property to dry out. Compare the cheapest housing loans from over 15 banks in Malaysia here. CBA is partnering with crypto exchange and custodian Gemini and blockchain analysis firm Chainalysis to design a crypto exchange and custody service to be offered to customers through a new feature in the banks app. Now Asb Economists See House Prices Falling Next Year Now You Read Me.